PropNex Picks

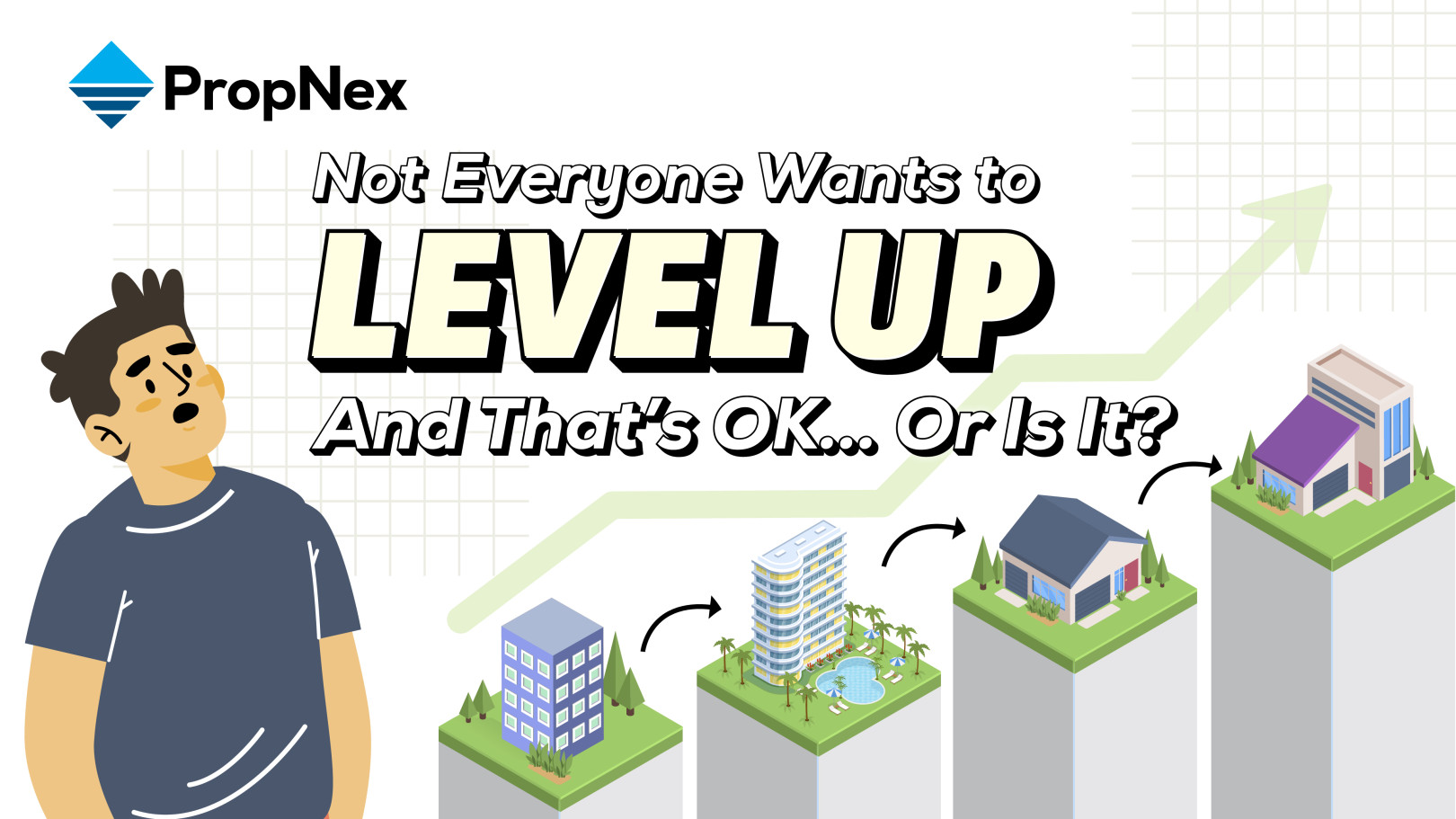

|July 18,2025Not Everyone Wants to 'Level Up' - And That's OK... Or Is It?

Share this article:

In Singapore, the idea of upgrading from public to private or even a landed property is often seen as a natural part of life's journey. You know the general drill - first BTO or resale HDB, then 'upgrade' to private property. But here's the twist: not everyone is chasing that next rung on the property ladder. Some are perfectly happy staying put in their comfortable HDB flats for life.

But could they be missing out? Let's dive into why some Singaporeans stick with HDB - and whether it's a choice worth rethinking.

There's something magical about familiarity. Your favourite hawker stalls, neighbours who double as lifelong friends, and that convenience store auntie who knows exactly which ice cream you're about to buy. Everything's within reach - MRT, schools, parks, and amenities.

But familiarity can sometimes lead to complacency. Comfort zones, while safe, can keep you from opportunities that push you further. Could holding on too tightly to what's comfortable actually be holding you back from bigger gains?

Let's talk dollars and sense. Many HDB homeowners eventually enjoy the sweet feeling of being mortgage-free. No monthly loan repayments, no stress about interest rates fluctuating. Plus, more CPF left untouched for retirement.

However, is peace of mind now worth potentially missing out on long-term financial growth? That fully paid-up flat might be sitting on untapped equity - money that could be working harder for you.

HDB conservancy fees? Super affordable - depending on your flat type, they typically range from $20 to $120 monthly for Singapore Citizens. Condo maintenance fees on the other hand? Not quite so - an average condo maintenance fee could range from a monthly fee of $300 to $700. And don't get me started on AGM meetings or debating whether the pool needs new tiles.

Sure, the fuss-free nature of HDB living is wonderful. But beyond simplicity, could you be potentially forgoing chances to multiply your financial returns by holding onto that flat and not progressing further?

HDB flats come with government assistance, subsidies, and stability. Plus upgrading programmes like the Home Improvement Programme (HIP) and Lift Upgrading Programme (LUP) ensure that your home stays functional and well-maintained.

And yes, some flats even hit the million-dollar mark! But while that sounds great, not every flat will see such appreciation. What if your home could help find your next big move - instead of just sitting pretty?

There's beauty in saying, "I'm good." No pressure to keep up with the Lees (or Lims, or Rahmans). No constant comparison with friends. No need to flex with bigger houses or newer condos. Just you, your family, and the lifestyle you're comfortable with.

But the market doesn't care about comfort. Prices rise, opportunities shift, and waiting too long could mean getting priced out entirely. While you don't have to follow trends blindly, being informed and adaptable is key.

Here's where we need to pause and think. Gone are the days when property was just a roof over your head - in today's context, it can be a powerful tool to build wealth, secure your future, and create generational value.

Sounds like it's only for the rich and famous?

Here's the truth: wealth-building and future planning are no longer luxuries - they're necessities, especially for the younger generation.

If you're still unsure, check out the highly sought-after Property Wealth System Masterclass - a programme designed to help everyday Singaporeans make smarter property decisions early, so they can maximise their options before time limits their opportunities.

So, could that HDB you're holding onto be holding you back? The property market offers opportunities for asset progression - turning one home into multiple investments over time. And those opportunities don't always come knocking.

By holding on too tightly to comfort, resulting in staying stagnant, you might miss the chance to unlock equity and make your money work harder for you. With strategic moves, that same HDB can be a stepping stone to larger investments, rental income, and long-term financial growth. Upgrading is not about flexing, nor is it something everyone HAS TO do; it's about understanding the current property market, staying ahead of inflation and rising costs.

PSF appreciation trend of HDB (Blue line) and Condo (Red line)

With every passing year, property prices increase, and what seems affordable today might become unattainable tomorrow. The graph above highlights a growing divergence between condo and HDB resale prices - a gap that has been widening and is likely to continue doing so. With this trend in motion, the opportunity to make a strategic move lies firmly in your hands. How you respond to this insight could significantly impact your future property journey and long-term financial position.

That being said, you need to know the financial reality of upgrading.

While you don't have to succumb to societal pressure to upgrade, it's important to remember that the value of money is constantly decreasing as inflation drives up the cost of everyday goods and services, reducing our purchasing power. What feels comfortable and sufficient today might not stand the test of time. So the real question is: are we making property decisions that future-proof our lifestyle - whether for ourselves or the next generation?

At the end of the day, choosing to stay in your HDB as your forever home is entirely your call. There's no right or wrong. But comfort shouldn't blind you to opportunity. It's important to ask: are you making decisions that benefit only the present, or are you safeguarding the future too?

If you're even a little curious about whether you're making the most of your home, it doesn't hurt to explore your options. Speak to any of our property advisers. Understand what your current flat could do for you. The next step may not just be an upgrade - it could be the key to financial growth and security for generations to come.

Because success isn't measured by square footage. It's measured by how well you future-proof your lifestyle, create financial possibilities, and make choices that serve you well for years to come.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.